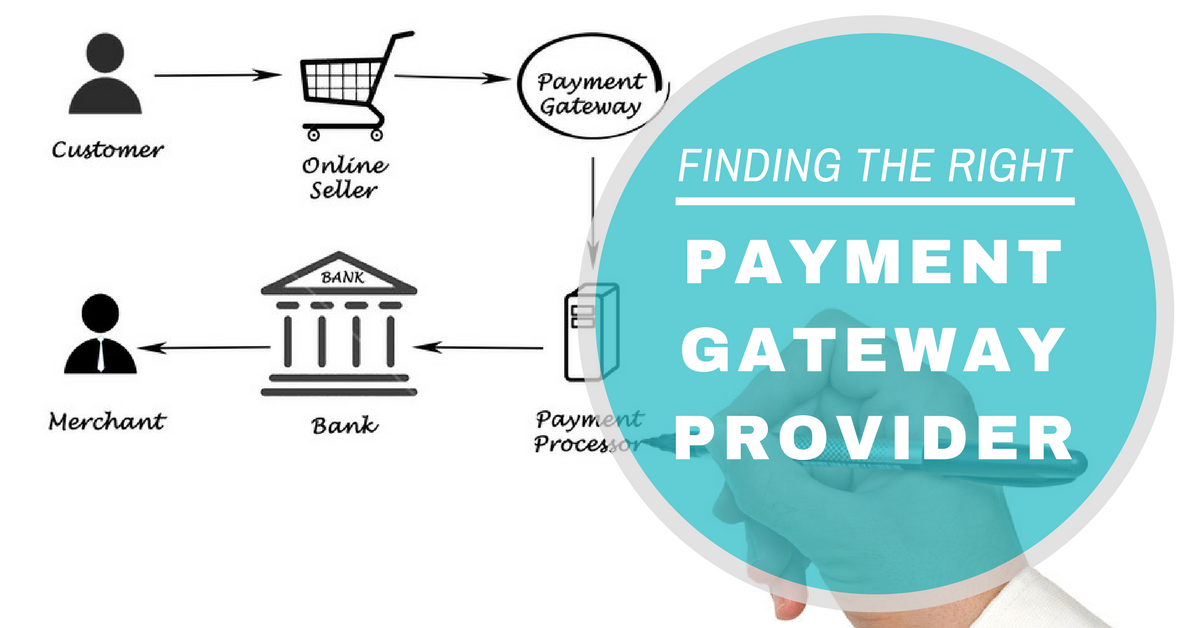

A payment gateway is a necessary part of any ecommerce business. It’s essentially the digital version of a brick-and-mortar store’s point of sale system: when you gather a customer’s payment information, you send it to a payment gateway, where it gets sent to the acquiring bank and then to the issuing credit card company.

Then the credit card company sends back a response that lets you know whether there’s enough credit in the account to complete the purchase. A good payment gateway can help your business succeed by streamlining your transactions and making sure you get paid!

Because payment gateways play such a vital role in any online business, selecting a good payment gateway is important. But the qualities of a “good” payment gateway will depend on your needs as a business. Read on for what to keep in mind when you’re in the market for payment gateway providers.

- Scalability and flexibility — If your payment gateway provider has inflexible or limited processing options, it may cause decreased performance, increased costs and processing bottlenecks over time. This will negatively impact your customers’ experience and might even drive them away. And that’s going to hurt your bottom line. Think about how you’re hoping to grow: Does your payment gateway provider offer options for international currencies in case you want to expand overseas? What about recurring payments for a subscription service? Don’t just choose a good provider for your business right now, but consider how your gateway provider can accommodate your anticipated growth.

- Security — Credit card fraud isn’t going away, and data security is more important than ever. Fraud and data leaks can irreparably harm the trustworthiness and reputation of your business. Customers won’t spend money at businesses if they’re concerned about security, and rightly so. Don’t skimp. Find a gateway provider that will work with you to keep your customer’s sensitive payment information safe. Some payment providers even specialize in fraud detection, which is something you may want to look into if you are a high volume merchant. Another security feature offered by some payment gateway providers is tokenization. This process allows card information to be removed entirely from the transaction, adding an extra layer of security. The good news is that safety pays off: more secure gateways lower risk and as a result boast lower processing costs.

- Cost of compliance — This ties into security concerns as well. New and evolving regulations create more complexity and increased costs to remain compliant. Make sure that your payment provider is up-to-date in their compliance — for example, are they Payment Card Industry Data Security Standard (PCI-DSS) Level 1 compliant? Your payment gateway provider should make it a priority to be on top of any new regulations to ensure that you are protected.

- Adapting to emerging technology — The rise of ecommerce has opened up new sales opportunities, but also significant new vulnerabilities. Your payment gateway provider should keep on top of everything that’s happening with your business. Find a provider that offers detailed reporting so you can analyze all your transactions. Real-time insight and updated systems with comprehensive reporting can enhance your profitability. You’ll want the ability to review your transactions, look at any chargebacks, or see any fees that you’ve incurred.

- Integration — Make sure your payment gateway is compatible with your site. The sleeker the integration, the easier it will be for your users to make purchases. Most payment gateways try to be compatible with a wide variety of systems to maximize their customer base, but keep in mind if you have any specialized needs.

- Specialized for high risk — If you’re a high-risk merchant, you’ll probably need special services. There are many factors that could contribute to your “high risk” categorization, like the product you’re selling, the amount of money you’re making, or the countries you’re selling to. Often, the common denominator is the risk of chargeback fraud. Chargeback fraud, or “friendly fraud,” is the reversal of a credit card payment initiated by a consumer who claims a legitimate purchase is fraudulent. If your industry has a high chargeback ratio, you should be sure that your payment gateway provider has chargeback management that can assist you.

- Support — Finally, just like any other business, customer service is important. Your payment gateway provider is going to be an integral part of your business, so you’ll want one that’s responsive and makes your business a priority.

A payment gateway will be an important part of your ecommerce business, so it’s vital to choose one that works for you. When selecting a payment gateway, keep in mind what your business needs and priorities are, as well as your anticipated growth. With careful research, you’ll be able to select a payment gateway that fits your needs, makes your transactions seamless, and helps your online business grow to its full potential.